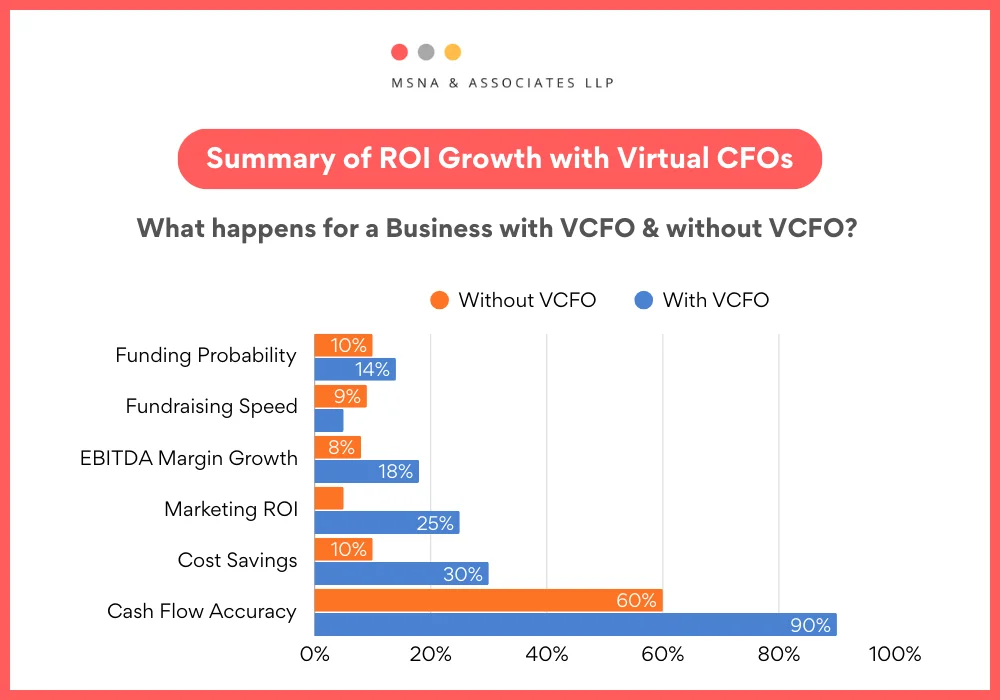

As a founder, you’re constantly making critical decisions tied to finance. But with a virtual CFO, you can simplify and strengthen your financial management.

It is also essential to choose the one who aligns with your requirements. To help you make an informed choice, we have compiled 10 questions to ask a virtual CFO before hiring one.

Top 10 Questions To Ask a Virtual CFO: Founder’s Edition

1. What experience do you have with businesses in my Industry?

As a founder, this is the first and foremost important question to ask a virtual CFO before hiring. As every industry has different financial dynamics, regulatory guidelines, growth models, and risk factors, you need to choose someone who understands your domain’s nuances.

Indian industries, specifically MSMEs and startups, deal with different compliance requirements, sector-specific government schemes, and cash-flow pressures. Hiring an experienced Virtual CFO can provide you with contextual clarity and faster decision-making.

2. Do you have a team that we can count on, or are you working as an individual?

This is another question to ask a virtual CFO, as without a good team, handling the entire organization’s finance and accounting function will be a very difficult task.

A Virtual CFO who has a good team can delegate a lot of tasks to the team members, and you will be aware of the respective SPOC for each task. This will ensure that tasks happen seamlessly without overdependence on one single person. Many a time, relying on an individual over a professional firm can lead to a scenario of ‘Over promising and under delivering’, which is a common scenario.

3. How do you Handle Compliance and Regulatory Updates in India?

Compliance with changing regulations and laws is more important than handling finances and budgeting. Ensure the CFO keeps your business aligned with all statutory requirements, including regular filings, proper documentation, and prepares you for regulatory scrutiny.

An ideal virtual CFO stays on top of changing policies, from FEMA guidelines for foreign investments, SEBI rules for startups planning to list, other revised norms under the Companies Act, amendments in Income Tax laws, and labour law changes.

4. What Financial Systems and Tools do you Use?

Most Indian Virtual CFOs don’t rely entirely on spreadsheets, they bring an entire tech stack based on your business size, stage, and sector.

Ask what tools they use to automate and streamline financial data. Zoho Books and TallyPrime are the two most commonly used accounting packages.

From the perspective of financial dashboards, Power BI is a tool that many experienced VCFOs use to provide various insights to the board.

A CFO equipped with the right financial systems gives you better visibility into cash flow, burn rate, and profits. These financial data are specifically beneficial when you’re preparing for fundraising, audits, and board reviews.

5. Will you help in Strategic Planning and Forecasting?

Strategic planning and forecasting are the core services provided by virtual CFOs. They typically help businesses with the following:

- Business Forecasting

- Scenario Planning

- Growth Strategy

- Fund Utilization Plans

- Board and Investor Reporting

As a founder, ensure your CFO offers expertise in these areas as you navigate business challenges.

6. How do you Support Cost Optimization and Profitability?

Ask how a virtual CFO will cut excess costs without compromising on growth and compliance. This is specifically important if your business is financially lean.

A typical CFO optimizes expenses and boosts profits by:

- Auditing your spending to identify cost leakages

- Suggest better processes for your finance and accounting function

- Creating budget frameworks and approval systems

- Analysing how much it costs to serve a customer

- Providing real-time reports on profitability by segment, region, and business unit.

- Structuring finances and expenses to optimize taxes.

7. What is Your Pricing Model, and What’s Included in Your Services?

This is a crucial question to ask a virtual CFO, as communicating payment terms sets clear expectations, avoids confusion, and ensures a smooth financial relationship.

Some common pricing models CFOs offer are:

- A flat monthly retainer fee depending on business size, scope, and complexity – Most common type

- Hourly consultation fee

Here’s what is usually included in a CFO’s services:

While the exact inclusions vary by provider, here’s what you can typically expect:

- Accounting and book keeping

- Financial Planning & Forecasting

- Compliance & Statutory Filings

- Monthly Information System(MIS)

- Investor-Readiness Support

- Reporting & Insights

- Cost Control & Margin Improvement

- Strategic Business Advice

- Audit support services and yearly statutory filings

8. Do you Offer Investor Reporting and Board Meeting Support?

Look for VCFOs who offer transparent reporting and ensure your board has a clear picture of financial health and strategic direction.

Choose a Virtual CFO who offers:

- Investor Reporting Packs

- Custom Dashboards & Insights

- Board Meeting Support

- Fund Utilization Reports

9. How Scalable are Your Services as We Grow?

Scalability is one of the biggest concerns, especially for startups and mid-sized businesses that plan to grow fast but don’t want to overbuild early.

Look for CFOs who offer services that can be scaled up or down without the overheads of a full-time CFO.

Here’s what scalable support looks like –

- Early Stage: Basic budgeting, cash flow management, statutory compliance, and cost tracking.

- Growth Stage: Fundraising support, performance benchmarking, pricing strategy, and KPI tracking.

- Expansion Stage: Multi-entity accounting, global taxation guidance, and investor reporting.

- Pre-IPO/Exit Stage: Internal audits, governance setup, and corporate restructuring advice.

Ensure the virtual CFO services grow with you, ensuring the right support at the right time.

10. Can I Speak to a Few of Your Clients for Reference?

Finally, this is a smart question for which any credible virtual CFO should be ready to say ‘yes’.

When you’re entrusting someone with your company’s financial strategy, compliance, and investor communication, it’s natural to expect proof beyond brochure and pitch decks. Connect with real businesses that’ve worked with the VCFO to know about their credibility, performance, working style, and client experience.

Asking the right questions before hiring a virtual CFO can save your business time, money, and avoidable risk. Plus, evaluate not just the CFO’s technical capabilities, but also their alignment with your vision and growth needs.

Beyond the Questions to Ask Virtual CFO: Red Flags to Watch Before Hiring

While asking the right questions is essential, being alert to red flags can save you from costly partnerships.

A few warning signs to look out for are:

- Lack of relevant experience and business knowledge.

- No clarity on deliverables.

- Unavailable or unresponsive communication.

- No verifiable references or case studies.

- Unfamiliarity with Indian compliance and tax laws.

- One-size-fits-all approach to financial planning.

- Poor data security practices.

- No team to work with

- Overpromising unrealistic outcomes.

Trust your instincts, but verify facts before onboarding the right virtual CFO.

Book A 15 Minutes Consultation With Our Team

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to print (Opens in new window) Print

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

Related

Discover more from MSNA & Associates LLP

Subscribe to get the latest posts sent to your email.