Businesses and growing startups cannot manage day-to-day tasks, customers, teams, and finances single-handedly. Plus, without a well-defined financial strategy and access to expert guidance, they often miss growth opportunities, face cash flow issues, and make compliance mistakes.

That’s why outsourcing a CFO is the best option. They take charge of your financial management, giving you time to focus on your business’s daily workflows.

Choosing outsourced CFO services in India gives you access to everything from budgeting and forecasting to risk management and compliance. In this article, you’ll get to know the top seven reasons to choose outsourced CFO services in India. Let’s get started.

7 Reasons to Choose Outsourced CFO Services in India

Top seven reasons to choose outsourced CFO services in India:

- Cost-Effectiveness

- Access to Financial Expertise

- Strategic Financial Planning

- Technology-Driven Insights

- Financial Reporting & Compliance

- Scalability and Flexibility

- Focus on Core Business Activities

1. You Save Cost with VCFO Services

Cost-effectiveness is the most compelling reason to opt for outsourced CFO services. Hiring a full-time CFO costs a hefty amount, including salary, insurance, retirement benefits, and overheads.

Cost-effectiveness is the most compelling reason to opt for outsourced CFO services. Hiring a full-time CFO costs a hefty amount, including salary, insurance, retirement benefits, and overheads.

However, outsourced CFOs offer equivalent expertise and services at a minimal cost. In addition, you get the flexibility to pay only for the services you opt for and redirect remaining funds to the key areas of your business, like scaling operations or marketing efforts.

Here’s how CFO services benefit you:

- Reduced pricing without any overheads.

- Access to senior talent without recruitment hassles.

- No hidden costs such as recruitment, onboarding, and training.

- Minimized costly errors through sound financial expertise and accurate reporting

2. Get Access to Financial Expertise by Outsourcing to VCFO

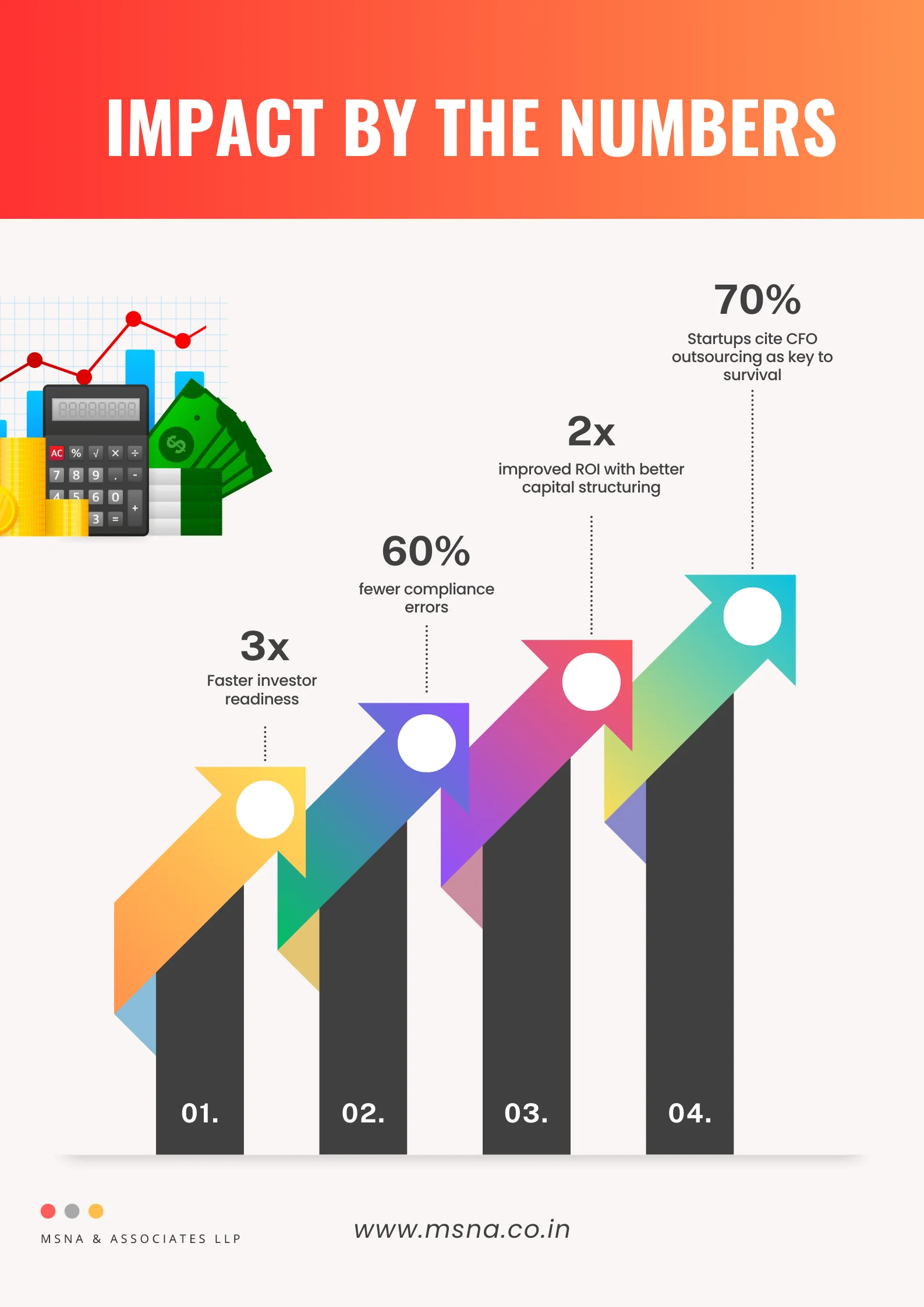

Virtual CFOs are industry experts across domains, ranging from finance and accounting to compliance and fundraising. This multi-sector exposure enables them to offer rich industry insights and help companies raise funding, survive economic slowdowns, and prepare for IPOs (Initial Public Offering).

VCFOs help you with:

- Creating forecasting models.

- Supporting fundraising and investor relations.

- Setting up internal financial records.

- Conducting financial health checks.

- Managing cash flow and cost structures.

3. They Offer Strategic Financial Planning

Developing strategic financial plans is important to expand your business sustainably. CFOs don’t stop with preparing reports, but develop short-term cash flow strategies and long-term capital plans.

By outsourcing VCFO services, they assist you with –

- Financial forecasting and planning.

- Budgeting is aligned with business goals.

- KPI and performance tracking.

- Investment and capital structuring decisions.

- Risk management and contingency planning.

4. They Add Value with Technology-Driven Insights

Cash flow shortages, overdue receivables, and poorly aligned cost structures are typical financial risks that many growing businesses face. However, these pitfalls can be identified, and necessary financial control systems can be implemented on time when you have an outsourced CFO to support you.

Outsourced CFOs offer technology-driven insights by:

- Leveraging financial technology for better visibility.

- Advanced forecasting and scenario planning.

- KPI dashboards and performance tracking.

- Reducing human error and increasing efficiency.

- Data-backed decision-making across niches.

5. Get Expertise in Financial Reporting & Compliance with VCFO

Adhering to ever-changing compliances and regulations is important to protect your business from penalties, enhance investor relationships, and operate with transparency.

An experienced CFO keeps your financial reports clean and up-to-date. They automate your reporting process, find errors early, and coordinate with your accountant or auditor when needed.

Outsourced CFO services can help you in financial reporting and compliance by:

- Timely and accurate financial reporting.

- Ensuring regulatory compliance.

- Handling audit readiness.

- Supporting global standards.

- Reducing risk and penalties.

Schedule III of the Companies Act, 2013 outlines the format and content requirements for financial statements that companies prepare. These disclosures are of paramount importance while preparing the financial statements of companies.

An Outsourced CFO will be well aware of the requirements and their implications more than a junior accountant in a company. Non-compliance with these requirements could invite penalties and scrutiny tensions to the companies

6. Scalability and Flexibility

As your business grows, your financial needs increase and might become complex. This is where outsourced CFO services become essential. They offer scalable and flexible solutions to your evolving financial demands.

A survey by The Finance Story reveals that outsourced CFOs in India have successfully supported businesses ranging from INR 50 crores to INR 500 crores in revenue, showcasing their ability to scale services in line with business growth.

Initially, start small with basic services like budgeting and forecasting. With time and increased financial needs, you can opt for services like capital structuring, investor reporting, international expansion, and merger planning.

As Virtual CFO’s work with different organizations, their business acumen will usually be stronger, and they will be able to help you best of the best solutions from their cross-business experience.

With the Outsourced CFO’s Scalability Function, you can:

- Get flexible support that fits your business needs.

- Scale your team up or down.

- Stay on track through changes in your business.

- Access skilled professionals in every function.

7. Focus on Core Business Activities

The Economic Times reports that approximately 60% of startups fail due to cash flow mismanagement. Outsourced CFOs provide the necessary financial oversight, allowing business leaders to concentrate on core operations.

This is one of the strongest reasons to consider outsourced CFO services in India, as it also lets you focus on core business operations, such as team building and product development, while the hired CFO will look after cash flow worries and compliance deadlines.

Outsourced CFOs free your financial workload by:

- Delegating complex financial management.

- Streamlining periodic audits and tax filings.

- Leadership bandwidth is freed up.

- Offering strategic support without full-time overhead.

- Letting you concentrate on core functionalities.

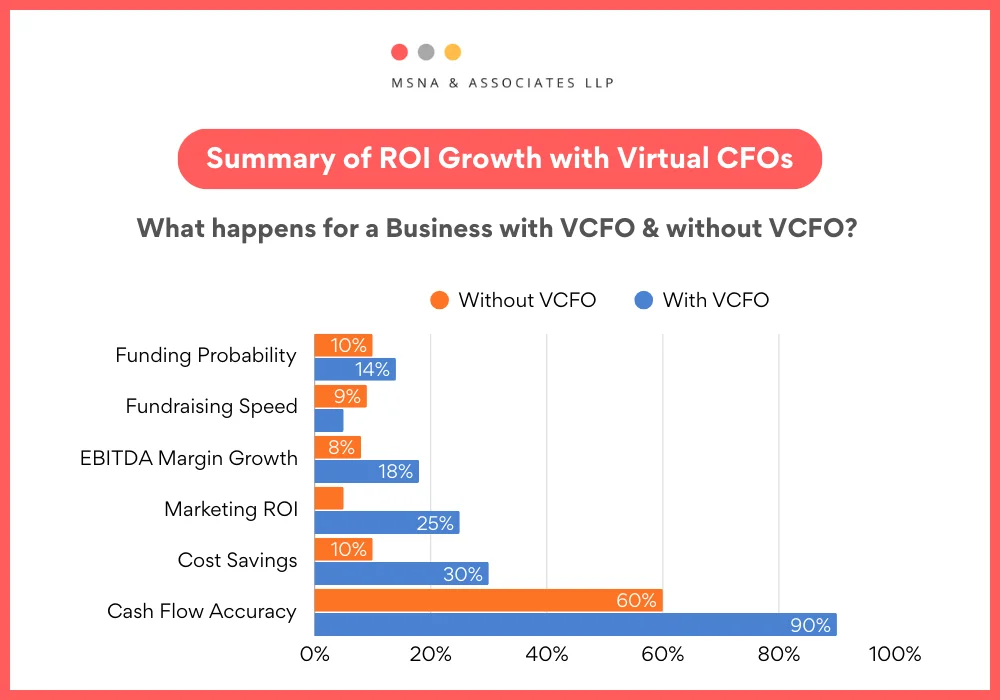

For more insights, read this article on how outsourced CFOs help businesses in maximizing ROI.

Why You Should Choose India for Outsourced CFO Services?

Deeper insights on why businesses should choose Virtual CFOs from India –

- India produces thousands of globally trained and technically sound Chartered Accountants, MBAs, and finance experts every year.

- Indian professionals offer similar expertise at significantly lower rates compared with CFOs in the US, UK, and Australia.

- Indian CFOs support businesses across different time zones, often handle back-end financial operations overnight, and prepare everything by the morning.

- With high English proficiency and business exposure, Indian CFOs work end-to-end with international teams.

By outsourcing CFO services in India, you’re not only saving money but also adding strategic value to your financial responsibilities. This quick guide on how to hire a Virtual CFO for your business can help your decision-making strategy.

Final Words

By opting for outsourced CFO services in India, you get access to top-tier expertise, industry insights, and strategic financial planning without any need for hiring an expensive in-house team.

At MSNA & Associates LLP, we help businesses focus on their core operations while we take care of their accounts, finances, and compliance needs. Whether you are a startup, a growing company, or an established firm, our outsourced CFO services will make a real difference to your finances.