“90% of Indian Startups fail within the first 5 years, with financial mismanagement being the top cause” – reported by IBM Institute for Business Value.

Startups are exciting, fast-paced, and have tons of potential… but managing finances can be tricky.

Founders tend to focus on building the product, getting customers, and growing the business, but without strong financial management, even the very best ideas can fail.

A Virtual CFO for startups comes in handy there. Instead of hiring a full-time Chief Financial Officer (CFO), startups now can hire a Virtual CFO who can take care of financial planning, budgeting, and cash flow management, including fundraising strategies, all flexible and remotely. We call them Outsourced CFOs.

If you’re not sure if you need one, then this guide will walk you through everything a Virtual CFO for startups can do for your bus90iness to help it grow.

Table of Contents

What is a Virtual CFO, and Why Should Startups Care?

A Virtual CFO is exactly what it sounds like—a Chief Financial Officer, but remote. Rather than a full-time employee in your office, they are a part-time or contract employee offering you financial expertise only when you require it.

This is game-changing for startups. When a startup is just getting started, hiring a full-time CFO can be expensive, but hiring a Virtual CFO for Startups can provide the same level of expert advice for a fraction of the fee.

Without breathing down your neck or taking up your office space, they use digital tools and cloud-based accounting software, and online meetings, to keep your finances in check. You can learn more about what is Virtual CFO & their roles here.

Why Are Startups Choosing Virtual CFOs in India?

“Virtual CFOs bring critical financial oversight to startups without burning a hole in the founder’s pocket. They help shift the focus from reactive firefighting to proactive financial strategy.”

Priyanka Anand, Founder of Financeezy

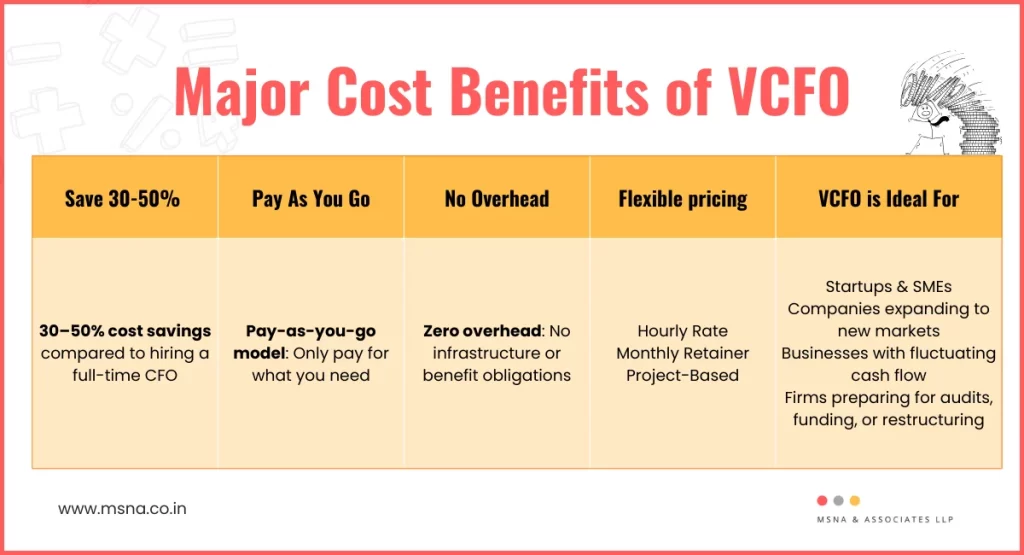

Financial mistakes can be painful, and startups run on tight budgets. Virtual CFO for startups brings professional financial planning at a fraction of the price of a full-time hire.

Some key benefits include:

- Cost savings – You can get top-notch financial advice without paying a full-time salary.

- Smarter decision-making – Data-driven insights help you to grow strategically.

- Better fundraising support – Helps with investor relations and financial planning.

- Cash flow management – Helps you from running out of money.

- Regulatory compliance – Makes sure taxes and filings are done correctly.

According to BCL India, the Virtual CFO services market is expected to grow at a CAGR of 15.6% from 2023-2030. With this, you can get an idea of how a Virtual CFO will be in high demand in the upcoming years.

What Are The Biggest Financial Challenges Startup Face without Virtual CFO?

One of the hardest parts of running a startup is managing money. Founders often struggle with:

1. Cash Flow Problems

While startups do fail for a wide range of reasons, many simply run out of money. A virtual CFO for startups makes sure you always know where your cash is going and helps save you from a cash shortfall.

2. Poor Budgeting

Without sound budgeting, startups can overspend or underinvest in important areas. A Virtual CFO starts with creating a clear financial plan that allows you to grow sustainably.

3. Struggles with Fundraising

Investors don’t just fund great ideas, they fund financially sound businesses. A Virtual CFO for startups gives you good numbers and a good pitch for those investors.

4. Tax and Compliance Issues

Missing tax deadlines and not following regulations often hit startups with penalties. The Virtual CFO for startups keeps your startup on the right side of the law.

As found in a survey, around 90% of startups fail because of financial mismanagement. While there might be many reasons for a startup to fail, finances remain one of the top reasons for startup failure.

How a Virtual CFO Service Helps Startup Grow?

What exactly does a Virtual CFO for startups do, then? Here are ways that they can help your businesses succeed:

1. Outsourced CFO Services Offer Smarter Financial Planning

Startups shouldn’t make random spending decisions, they need solid financial strategies. A Virtual CFO for startups will take a look at your revenue, expenses, and market trends to establish a financial roadmap that will keep your business on the right track.

2. VCFO Offer Fundraising Support

If you’re looking to raise funds, a virtual CFO is a must. They help with:

- Investor pitch decks – Helps in creating strong financial presentations.

- Valuations – Making sure you do get the funding at the right price.

- Financial projections – Making your startup attractive to investors.

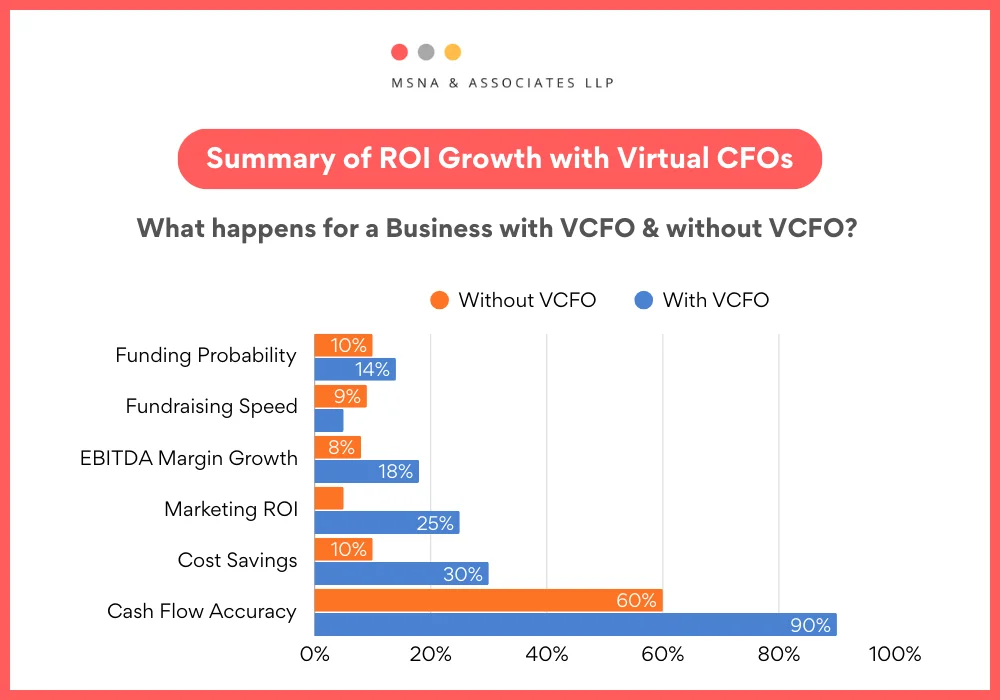

A case study revealed that a tech startup that implements Virtual CFO services increases its marketing ROI by 25% through fund allocation.

“Startups today prefer VCFOs as they act as strategic partners. We’ve observed that startups backed by a Virtual CFO were 40% more likely to secure early-stage funding.”

An Insight by BCL India

3. They Help in Cost Optimization

Many startups waste money without even knowing it. A Virtual CFO for startups focuses on cutting unnecessary costs and helps businesses not forget about the spending that generates growth.

4. VCFO Ensures Compliance and Avoid Legal Trouble

How does a startup get fined for missed tax filings or not being compliant?

It happens all the time. A Virtual CFO helps you to keep your finances clean and compliant.

When Should Startups Consider a Virtual CFO?

Not sure if your startup needs a Virtual CFO? Here are some signs:

- You’re growing fast and require a financial structure.

- You’re raising funds and need expert financial help.

- Your cash flow and financial planning are killing you.

- You don’t know how to deal with taxes and compliance.

We can say that the Virtual CFO are getting noticed by founders.

The global virtual CFO market was valued at $1.29 billion in 2020 and is growing at a rate of 15.1% per passing year.

What Is The Role of Technology in Virtual CFO Services for Startups?

Virtual CFO for startups uses technology to make financial management seamless.

1. VCFOs’ Use AI and Automation

Virtual CFOs use AI-driven insights such as:

- Predict trends in revenue and cash flow.

- Identify areas where you’re overspending.

- Automate tax and compliance processes.

2. Cloud-Based Accounting

Virtual CFOs use tools like Zoho Books and Xero to:

- Maintain real-time financial records.

- Generate automated reports.

- Streamline bookkeeping and invoicing.

3. Data-Driven Forecasting for Startups!

A Virtual CFO for startups with predictive analytics can spot potential risks before they become big problems. A Prophix Software survey finds that 20% of finance teams can forecast revenue and earnings for more than 12 months.

Future of Virtual CFO Services for Startups: An Analysis by Our Expert

“The adoption of virtual CFO services in India has increased post-COVID due to cost pressures and the digital finance revolution.”

An Info by Rajesh Mohanan, Chartered Accountant & Founder at CA Monk

The model of the Virtual CFO for startups is only growing stronger. Some industry trends include:

- Industry-Specific CFOs – CFO experts in SaaS, e-commerce, and fintech with well-defined financial strategies for each business model. That means you get advice that actually pertains to your industry.

- AI-Powered Insights – Helping startups automate their financial planning and forecasting through advanced automation and data-driven decision-making. No more guessing—just smart financial moves. Power BI is also a tool that virtual CFOs use for decision making.

- On-Demand CFO Services – Flexible, subscription-based CFO support so startups can have access to expert financial guidance without the long-term commitment of a full-time hire. You get expert help when you need it.

These trends will help make startups even more affordable and powerful in financial management solutions.

Final Thoughts: Why Every Startup Needs a Virtual CFO

Having a Virtual CFO for startups is no longer a luxury, it’s a necessity for startups that are looking to scale successfully.

A Virtual CFO for startups helps businesses with expert financial guidance, including:

- Avoid cash flow crises.

- Make smarter financial decisions.

- Secure funding faster and at better valuations.

- Keep your company and yourself out of trouble.

When you’re a startup founder, trying to take control of your finances, a Virtual CFO for startups might be the smartest move you can make. You can skip the stress of having to worry about the money with financial expertise specifically designed to help you grow your business.