How to Hire Virtual CFO in Bangalore? This Guide Explains All You Should Know!

Running a business in Bangalore is no small task. Between keeping up with taxes, managing cash flow, and planning for growth, it’s easy to get lost in the numbers.

That’s where a Virtual CFO comes in. Virtual CFOs are often called an Outsourced CFO or a Fractional CFO. For founders and growing companies, virtual CFO services for small businesses provide expert financial guidance without the cost of hiring a full-time executive. Think of them as your financial co-pilot — someone who understands your numbers, guides your money decisions, and helps you avoid costly mistakes while keeping your business financially healthy.

Startup founders especially should know how to hire a Virtual CFO in Bangalore. These experts help streamline finances, improve profitability, ensure compliance, and support smart scaling decisions.

And the best part? You get top-level financial expertise minus the top-level salary. In this blog, we’ll break down what a Virtual CFO actually does, why Bangalore businesses are hiring them like never before, and how you can choose the right one for your team.

Let’s get into it.

Overview on Hiring A Virtual CFO in Bangalore

Let’s start simple. A Virtual CFO is like a financial expert you don’t see in the office, but they’ve got your back. They work remotely and help businesses manage money, make smart decisions, and stay out of financial trouble, without the need to hire a full-time CFO. You’ll get deeper insights into “What is Virtual CFO” in our linked expert guide.

An outsourced CFO in Bangalore works on a contract or part-time basis, compared to a regular CFO who sits in your office every day. This means you’re only paying for what you need. It’s budget-friendly and super flexible, perfect for startups and growing businesses.

Their job can include a lot of things – financial planning, budgeting, reporting, and risk management. They also help with forecasting, tax planning, and making sure your business stays on the right side of the law. Their experience of working with a lot of other businesses will surely help you in your business.

Hiring A Full Time CFO? Let's Compare It With Virtual CFO

The biggest difference? The traditional CFO is full-time; the other isn’t.

A traditional CFO is like a senior team member. They’re involved in every part of your business and come with a big salary package.

A Virtual CFO, on the other hand, works remotely and offers services on demand. They give strategic advice, keep an eye on your finances, and make sure your company follows rules, without needing a permanent desk in your office.

So, while the traditional CFO handles everything, the Virtual CFO services in Bangalore focus mainly on financial strategy, reporting, compliance, and smart money moves.

A full-time CFO is a must for very big organizations that need the support full time. For small, mid and growing organizations, a virtual CFO does the same job without being there full time.

Who Hires a Virtual CFO in Bangalore?

Virtual CFOs in Bangalore are a big hit with:

- Small and medium-sized businesses (SMEs).

- Startups

- Direct-to-consumer (D2C) brands

80% of SMEs lack financial advice, paving a great opportunity to access it by hiring the Best Virtual CFOs in Bangalore.

These companies often don’t have the budget for a full-time CFO, but still need someone to steer the financial ship. That’s where a Virtual CFO comes in.

Startups especially love them. Why? Because they can scale services up or down depending on where the business is headed. There are no long-term commitments, no high salaries, just smart financial help when needed.

Why Are Bangalore-Based Businesses Choosing Virtual CFOs?

Bangalore is buzzing with startups, tech companies, and e-commerce brands. It’s a city that never sits still; new businesses are popping up all the time.

According to NASSCOM, Bangalore hosts around 8,000 startups, making it India’s largest startup hub.

And with that fast growth comes complex financial needs. Many businesses here are raising funds, expanding rapidly, and navigating India’s ever-changing tax and compliance landscape. Hiring a full-time CFO at this stage may be unnecessary or simply too expensive for a growing company.

This is where virtual CFO services for small businesses become a practical solution. A Virtual CFO brings the right mix of flexibility, local expertise, and cost-effectiveness. They understand Bangalore’s dynamic business environment, stay current with tax and regulatory requirements, and help companies scale confidently without stretching their budgets.

With strategic financial oversight, better compliance planning, and real-time insights, businesses can move faster, make smarter decisions, and grow sustainably — without the financial burden of a full-time executive.

The Local Edge: Bangalore’s Unique Business Needs

Bangalore’s business scene is unique. Companies here face:

- Rapid growth and change

- Complicated state tax and financial rules

- The need to raise capital really fast

However, Virtual CFOs in Bangalore are tuned into these challenges. They’ve worked with tech companies, ecommerce platforms, and investor-backed startups. They know what’s needed — whether it’s helping close a funding round, fixing cash flow, or staying audit-ready.

And now, with most businesses embracing remote work, hiring a Virtual CFO in Bangalore just makes sense.

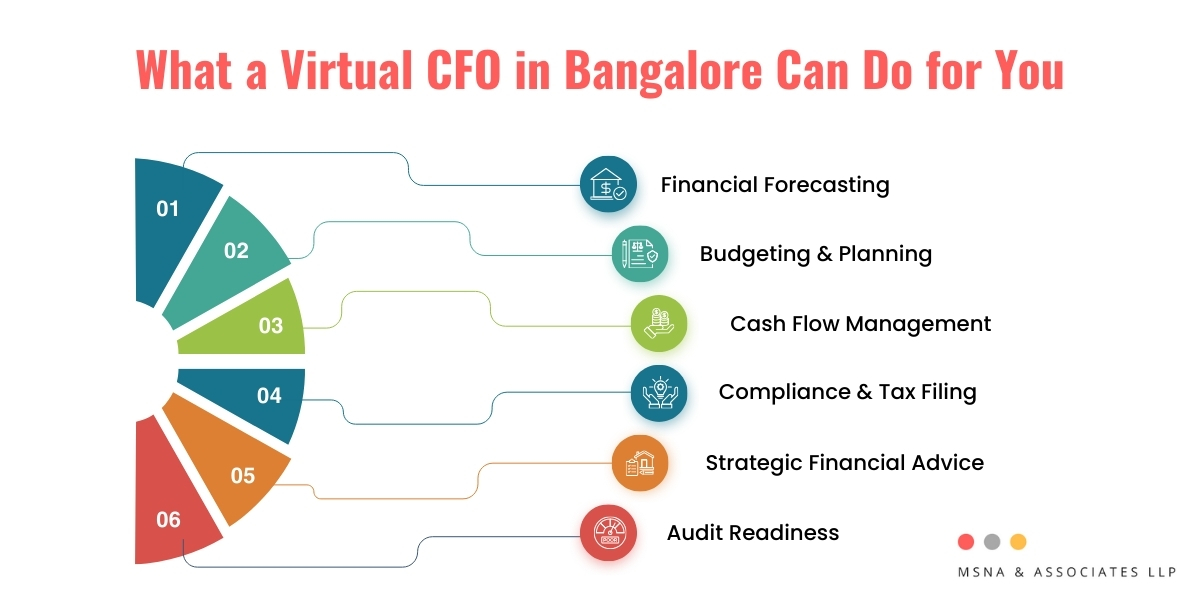

What Services Do Virtual CFOs Offer?

Let’s break it down. A Virtual CFO is your go-to for all things finance. Here’s what they can help with:

1. Financial Forecasting

They help predict your future revenue, expenses, and cash flow. This helps you plan your next move, whether it’s hiring more people, launching a product, or even saving cash.

2. Budgeting

They work with you to build and stick to a realistic budget. No more overspending. No more financial surprises.

3. Tax Compliance

India’s tax rules are no joke. A Virtual CFO helps you stay compliant, file returns, plan taxes, and avoid penalties.

4. Cash Flow Management

They help track your money — what’s coming in, what’s going out. And they make sure you always have enough cash on hand to run your business smoothly.

5. Financial Reporting

Need a profit and loss statement? Balance sheet? Cash flow report? A Virtual CFO prepares all the essential reports you need to understand your business’s financial health.

6. Strategic Planning

They don’t just crunch numbers; they help you make big decisions. From planning investments to cutting costs and improving profitability, they’re your financial sounding board.

What Are The Benefits of Hiring Virtual CFO for Your Bangalore Business?

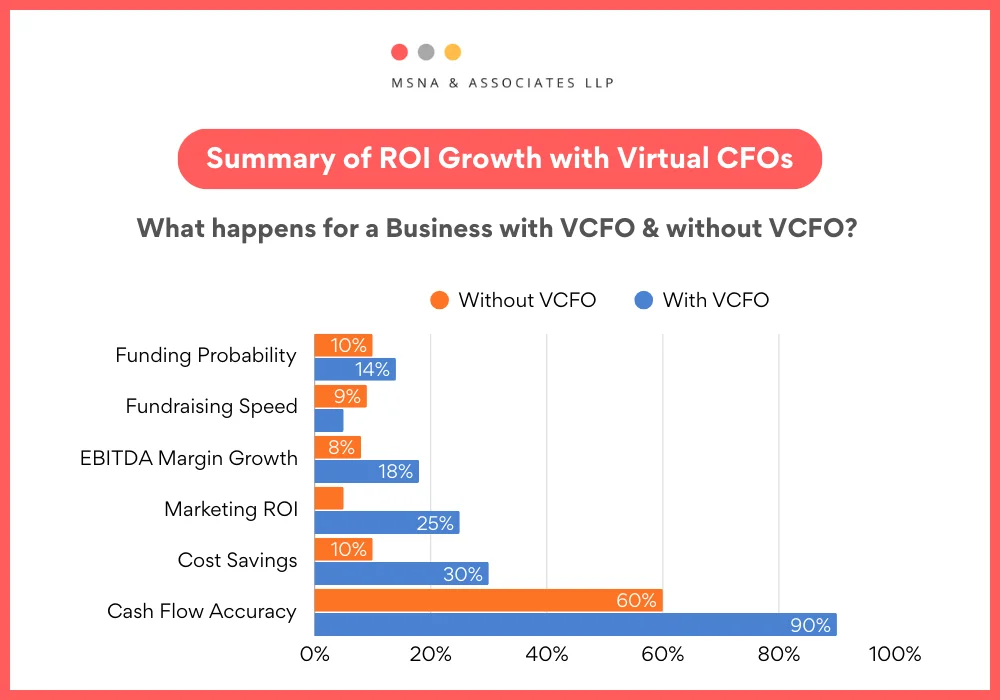

A recent report from the IBM Institute for Business Value states that 70% of the startups fail due to lack of financial management skills.

Lack of access to financial expertise has become a great obstacle for small businesses. VCFOs are the great rescuers of Startups & Small businesses in Bangalore.

Let’s talk about why it’s a great idea to bring Best Virtual CFO to your C-Suite Table –

1. Cost-Effective

Hiring a full-time CFO can burn a hole in your pocket. A Virtual CFO offers the same expertise, without the high salary or overhead. You only pay for services that you want to use. Fractional CFOs can reduce your financial overhead by 30-50% vs full-time CFOs.

2. On-Demand Help

Whether you require financial advice, crisis assistance, or coaching during expansion, a Virtual CFO is only a phone call away.

3. Help with Fundraising

Looking for investors? A Virtual CFO can prep your finances and projections so you look investor-ready and confident.

4. Scalable Support

Need more help during tax season? Or less during the off-season? A Virtual CFO can scale their services based on your needs.

5. Compliance and Audit-Ready

They’ll ensure your business follows the rules and is ready for any audits. No more last-minute mess-ups.

When you hire a Virtual CFO in Bangalore, you’re not just hiring someone to do math. You’re hiring a partner to help your business grow the smart way

6. Contract Analysis and Negotiation:

To identify potential risks and opportunities, virtual CFOs review contracts with stakeholders, including employees, vendors, and customers.

7. Determine Business Value:

Virtual CFOs offer services tailored to your needs. It helps in achieving the maximum value while aligning with your long-term goals.

8. Strategic Planning:

It helps in strategic planning by developing a financial model for forecasting and offering advice on capital structure and risk management.

9. Risk Management

It helps in identifying, assessing financial, operational, and regulatory risks by implementing internal controls and developing strategies.

How to Hire the Right Virtual CFO in Bangalore?

There are plenty of experts out there, but not all will be the right fit. Here’s how to pick one that actually works for you:

1. Check Their Experience

Have they worked with other companies like yours? Do they understand your industry business? Experience matters — especially when it comes to handling your money.

2. Know What You Need

Some businesses need full financial management. Others just need help with taxes or budgeting. Make sure the Virtual CFO offers the services you actually need.

3. Clear Communication

They should be able to explain things simply. You don’t need jargon — you need clarity. Good communication is non-negotiable.

4. Pricing Model

Ask about how they charge — hourly? Monthly? Fixed project cost? Make sure it fits your budget before you commit. Whether you need complete Virtual CFO services in Bangalore or just help with one-off financial tasks, make sure your pick aligns with your goals.

Virtual CFO vs Accountant vs CA Firm: Who Should You Hire in Bangalore?

| Criteria | Virtual CFO | Accountant | Traditional CA Firm |

|---|---|---|---|

| Primary Role | Strategic financial leadership and decision support | Bookkeeping and transaction recording | Compliance, audits, tax filings |

| Business Involvement | Works closely with founders and management | Limited to data entry and records | Periodic or year-end engagement |

| Financial Strategy & Forecasting | Builds forecasts, cash flow models, and growth plans | Not involved | Limited advisory |

| Fundraising & Investor Support | Prepares pitch-ready financials and projections | Not involved | Occasional support |

| Cost Structure | Flexible, part-time or retainer-based | Fixed monthly or hourly | Engagement-based |

| Scalability | Easily scales with business growth | Limited scalability | Requires new engagements |

| Decision-Making Support | Actively guides pricing, expansion, and cost control | No strategic role | Advisory only when asked |

| Ideal For | Startups, SMEs, fast-growing businesses | Very small businesses | Compliance-focused organisations |

Common Mistakes To Avoid While Hiring Virtual CFO in Bangalore

Lack of hiring knowledge when it comes to hiring VCFOs can result in loss of 30% of your revenue as per the credible sources we found. Hence, we are adding this valuable insight for SMEs & Startups.

Before you hire an outsourced CFO in Bangalore, here are a few things to watch out for:

1. Choosing Based on Price Alone

Sure, budget matters. But don’t just pick the cheapest option. Make sure they’re actually qualified and experienced. This is the worst mistake to make, especially when you are choosing a professional services firm.

2. Not Setting Clear Expectations

Be clear about what you need and expect. Set the scope of work right from the start to avoid confusion later. Enter into an engagement letter with the professional firm clearly defining the scope of work and scope exclusions.

3. Ignoring Compliance

Your Virtual CFO must be up to date with Indian tax laws and financial regulations. Don’t compromise on compliance — it could cost you big. Non-compliance usually costs more than compliance.

When to Bring in a Virtual CFO

A Virtual CFO can be a game-changer at various stages of a business’s lifecycle.

Startup Phase:

VCFO can assist with securing funding, creating financial projections, and establishing robust financial systems at the initial stage.

Rapid Growth:

VCFO can optimise financial operations, manage cash flow, and support strategic decision-making to help you navigate these challenges effectively when the business scales.

Financial Turbulence:

VCFOs who offer expertise in cost reduction, risk mitigation, and financial restructuring to help stabilise and guide your business through challenging times.

Planning for Financial Events:

Whether you are going for an IPO, acquisition, or sale, our Virtual CFO can enhance your company’s financial profile and valuation.

Hire Virtual CFO in Bangalore: Just Makes Sense

If you’re running a business in Bangalore, having your finances in order is non-negotiable. But hiring a full-time CFO? Not always practical or affordable if you are a growing organization just scaling up.

That’s why more startups, SMEs, and growing companies are turning to Virtual CFOs in Bangalore. They offer strategic support, cost savings, and the flexibility your business needs to grow smartly.

If you’re considering this move, make sure you choose someone who understands the local business scene. In the end, it’s not just about managing money, it’s about making your money work smarter for you. And that’s what you can accomplish when you hire Virtual CFO in Bangalore who is best at their job.

Get In Touch With Us for Virtual CFO Services in Bangalore

FAQs Related To Virtual CFO Services For Small Business

What is included in Virtual CFO Services?

What is role in Virtual CFO?

How to become virtual CFO?

How virtual CFO charge per hour?

Related

Discover more from MSNA & Associates LLP

Subscribe to get the latest posts sent to your email.

Pingback: Top 10 Questions Founders Ask Before Hiring a Virtual CFO - MSNA & Associates LLP

Pingback: Top Financial KPIs Measured by Virtual CFOs - MSNA & Associates LLP

Pingback: 10 Business Challenges Addressed by VCFOs in India - MSNA & Associates LLP

Pingback: When To Review/Build Your Company's SOP? VCFO Guide - MSNA & Associates LLP