Difference Between Virtual CFO & Traditional CFO: Which One Is Right for Your Business?

Running a business is exciting, but let’s be honest, the finance part? It can get overwhelming. Whether you’re a startup founder or a small business owner, there comes a time when spreadsheets, cash flow reports, and financial strategy start piling up. That’s when you need a CFO.

But here’s the twist: Should you hire a full-time, in-house CFO or go for a more flexible, remote option?

That’s where the difference between a Virtual CFO & Traditional CFO becomes important.

According to Grand View Research, the global virtual CFO market is expected to grow at over 17% CAGR between 2023 and 2030. Why? Because businesses want expert financial advice without the full-time cost.

In this blog, we’ll break down what each type of CFO does, how they work, and most importantly, how to choose the one that fits your business best.

What Is a CFO (In Simple Words)?

A Chief Financial Officer is the brain behind your company’s financial health. They handle everything from financial planning and budgeting to risk management and investor relations. They’re the person who can look at your numbers and tell you if your next big idea is genius or financial suicide.

But not all CFOs are created equal. Some work with you side by side. Others work remotely. And that’s where the real difference between a virtual CFO & traditional CFO begins

Traditional CFO: The In-House Powerhouse

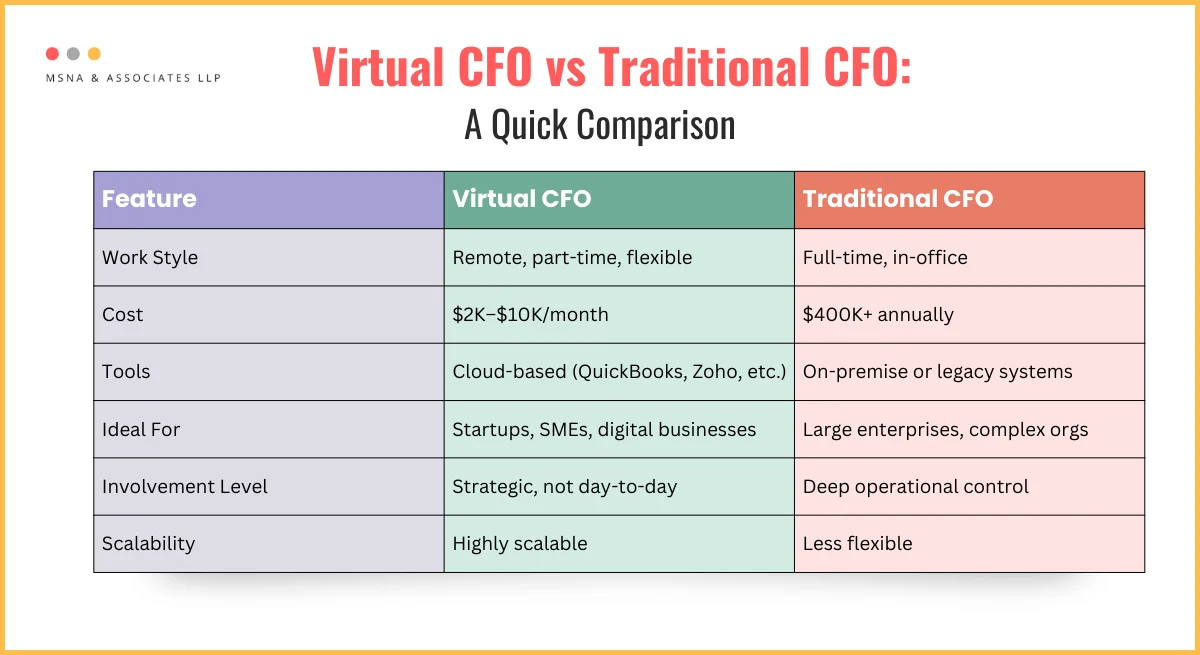

A traditional CFO is a full-time executive, physically present, deeply involved in operations, and often handling internal teams. They attend meetings, advise departments, and carry out board-level responsibilities. Think of them as the financial backbone of large enterprises where constant oversight is non-negotiable.

That said, they come with a cost. According to Salary.com, the average CFO salary in the US is $433,319 as of early 2025. This figure doesn’t include performance bonuses, stock options, and other benefits. For smaller businesses or startups, this can be hard to justify. The difference between a virtual CFO and a traditional CFO is evident when you look at the expenses involved.

Virtual CFO: The Flexible Financial Ally

A Virtual CFO, on the other hand, provides the same strategic expertise in a more adaptable and scalable manner. They work remotely, part-time, or on a project basis and usually juggle multiple clients. Instead of being physically present, they rely on cloud-based tools and virtual dashboards to guide your business.

Virtual CFOs have become increasingly popular with startups and SMEs, and for good reason. Pilot.com estimates the average cost of CFO services for a remote CFO for startups falls between $2,000 to $10,000 per month, depending on the level of service.

Virtual CFO vs Traditional CFO: What’s the Real Difference?

1. Cost and Accessibility

Hiring a traditional CFO is like buying a premium, all-inclusive package. You’re paying for their time, experience, presence, and leadership. But you’re also paying for office space, insurance, equity, and so much more.

A virtual CFO, however, is leaner and more modular. You only pay for what you need. In many cases, that’s more than enough to keep things running smoothly and strategically.

There’s a real-world example from a SaaS company, K38 Consulting, which highlights the benefits of outsourced CFO services. They helped a client not only reduce costs but also streamline reporting, improve financial forecasting, and prepare for investor presentations — all remotely. This shows how vCFOs can add high-level value without the traditional price tag.

2. Involvement in Daily Operations

Traditional CFOs are embedded in daily operations. They manage teams, lead initiatives, and make decisions in real time. For large organizations with multiple departments and complex structures, this is essential.

On the other hand, a virtual CFO focuses more on strategic oversight. They check in regularly but don’t get bogged down by internal politics or routine admin tasks. This setup works beautifully for businesses that value autonomy but still want top-tier financial advice.

The difference between a virtual CFO and a traditional CFO is mainly about the level of day-to-day involvement in operations.

3. Scalability and Flexibility

A traditional CFO represents a long-term commitment. You’re investing in someone who’s going to be with you for the long haul.

A virtual CFO is more agile. You can scale their involvement up or down based on your growth phase, making them ideal for startups and companies in transition.

Eric Ries, author of The Lean Startup, once said, “In today’s lean startup culture, flexibility is king.” Virtual CFOs embody that mindset, offering just-in-time strategy without unnecessary baggage.

4. Technology and Tools

Virtual CFOs thrive in digital environments. They use tools like Zoho, QuickBooks, and LivePlan to generate reports, forecast cash flow, and keep stakeholders informed. This digital-first approach means faster decisions, real-time updates, and fewer manual errors.

Traditional CFOs may continue to rely on old systems or specialized in-house software. While that works for larger firms, it can be a bottleneck for newer companies trying to move fast and stay lean.

When Does a Traditional CFO Make Sense?

Despite the buzz around virtual CFOs, traditional CFOs still have their place. If you’re managing a large enterprise with multiple revenue streams, international subsidiaries, or heavy compliance needs, a full-time, hands-on CFO is irreplaceable.

They offer a depth of control, internal culture alignment, and leadership that virtual counterparts often can’t match.

When Should You Choose a Virtual CFO?

If you’re a startup founder, solo entrepreneur, or small business owner, chances are you don’t need a full-time CFO just yet. A virtual CFO gives you access to strategic advice without the cost and complexity of a traditional hire.

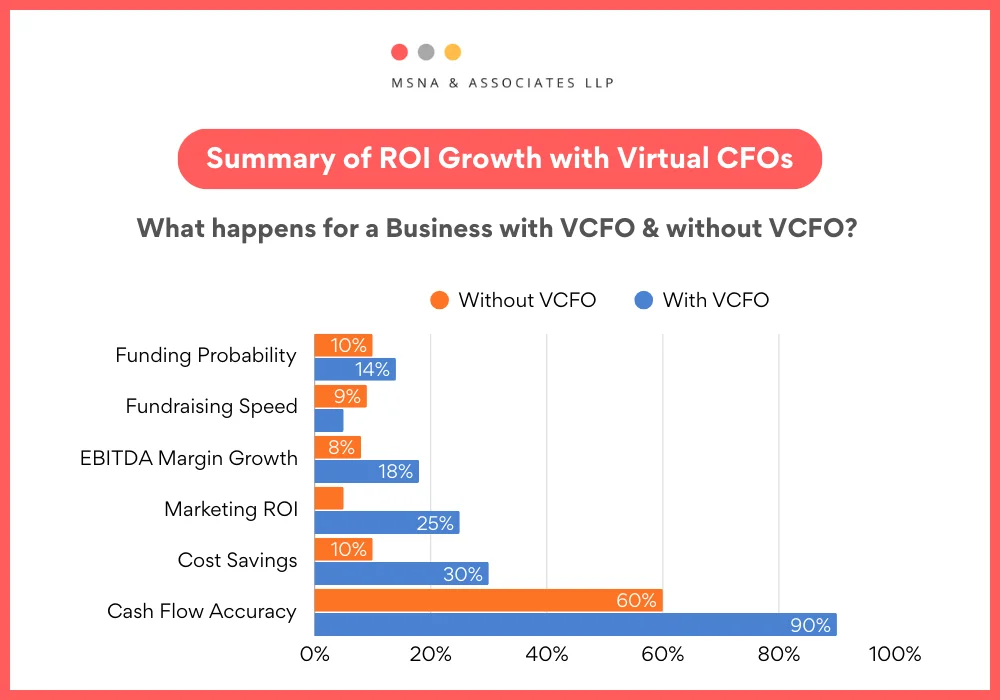

A growing number of small businesses are recognizing the value of outsourced CFO services. In fact, a report by GrowthForce found that businesses using virtual CFO services can reduce finance department costs by 20–30% while gaining deeper insights into cash flow and financial forecasting, key drivers of profitability.

A virtual CFO, usually a Chartered Accountant firm, has their own team members who are also experts in their respective fields and can help instead of a small business having an accountant team and a CFO to lead them.

Debunking the Differences Between Virtual CFO and Traditional CFO

Many people assume virtual CFOs are less reliable or less strategic. In reality, many are former CFOs of large corporations, consultants, or finance veterans who’ve chosen to work flexibly.

Others believe that virtual CFOs only suit early-stage startups. Again, not true. Mid-sized firms with stable revenue but limited in-house finance leadership often turn to vCFOs for long-term planning and fundraising strategies.

So, Which One Should You Choose?

Ask yourself the following: Do you need constant oversight or strategic input? Can you afford a full-time executive, or would a flexible partner serve you better? Is your business digital-first or operations-heavy?

If you’re not ready for a big commitment, start with a vCFO. You can always scale later.

Making the Right Choice: Virtual CFO vs Traditional CFO for Your Business

Understanding the difference between a virtual CFO and a traditional CFO isn’t just about job titles — it’s about what your business truly needs right now.

If you’re a growing startup or small business looking for flexibility, strategic insights, and cost-effective financial leadership, a virtual CFO might be your best bet. For larger, complex organizations needing hands-on control and internal leadership, a traditional CFO could be the right fit.

Whatever stage you’re in, having the right financial partner can make or break your next move.

If you’re looking for expert financial guidance without the overhead, working with a Virtual CFO firm could be the step that helps you move forward with confidence. At MSNA, we handle virtual CFO services for multiple growing organizations and are happy to see their business thrive with the right financial acumen and decision-making.

Contact MSNA For Consultation on your Virtual CFO Needs!

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to print (Opens in new window) Print

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

Related

Discover more from MSNA & Associates LLP

Subscribe to get the latest posts sent to your email.