Money is the lifeblood of every business. But how does one manage it effectively? This is when things become tricky.

A Chief Financial Officer (CFO) is in charge of a large company’s finances, including budgeting, forecasting, financial planning, and ensuring profitability.

However, hiring a full-time CFO is expensive, and not every business can afford it. That is where the Virtual CFO (VCFO) comes in, offering the cost benefits of VCFO by providing expert financial guidance at a fraction of the cost of a full-time CFO.

Instead of hiring a full-time CEO, organizations can outsource their financial leadership to a VCFO, who delivers the same assistance at a lower cost. In this article, we’ll look at how outsourcing a CFO may reduce costs by at least 30% and why more organizations are making the switch.

Analysis of Cost Benefits of VCFO vs In-House CFO

Table of Contents

Understanding the Costs of an In-House CFO

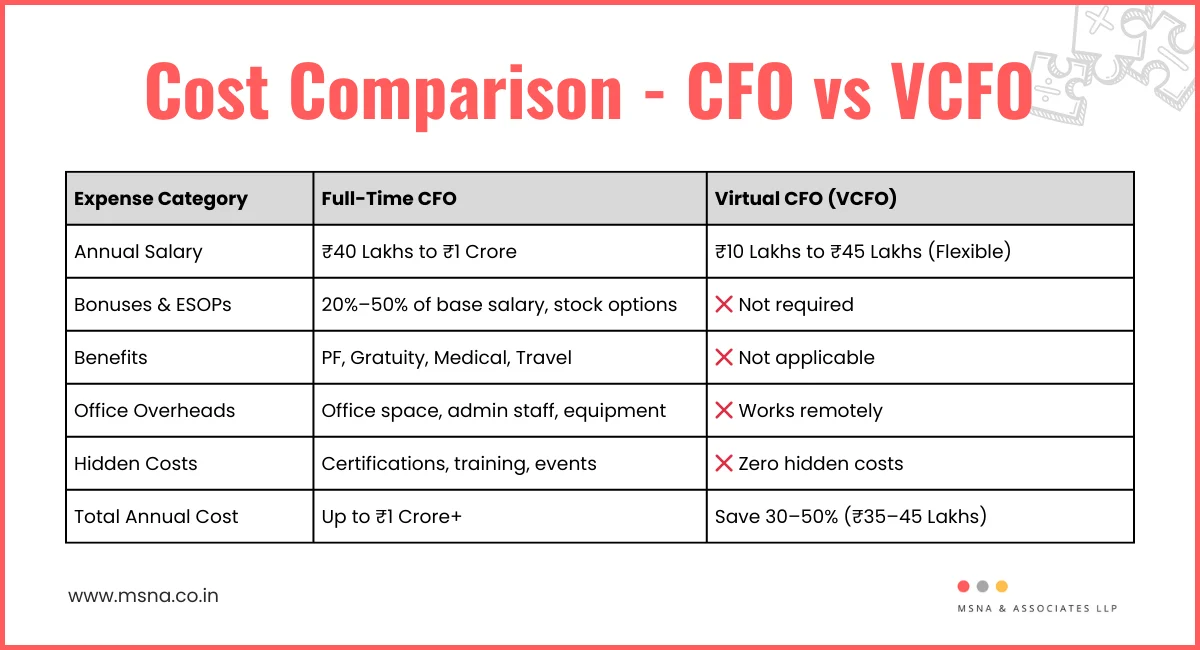

Hiring a full-time Chief Financial Officer (CFO) is expensive. A CFO is a senior executive who oversees a company’s financial health, makes strategic decisions, and ensures regulatory compliance. Because of their skills and expertise, they attract huge salaries and other benefits.

Consider The Cost of CFOs’ Salaries

CFOs are among the highest-paid executives in a company. In India, the annual salary of a full-time CFO typically ranges from ₹16 lakhs to ₹1 crore or more, depending on the industry, business size, and city. Start-ups and growing businesses often need to offer attractive packages to bring in top talent, which can quickly drive up costs.

Offered Benefits and Bonuses for CFOs

In addition to a high salary, full-time CFOs in India usually receive several other perks, such as:

- Health and medical insurance for themselves and their families

- Provident Fund (PF) and gratuity contributions

- Performance-based bonuses, often 20%–50% of their base salary

- Company stock options (ESOPs), especially in startups and tech firms

- Car lease or travel allowances, especially in large organizations

These additional benefits can significantly increase the total cost of hiring, sometimes by ₹10 – ₹30 lakhs or more per year.

Additional Overhead Expenses of the CFO

Having a CFO on the payroll is about more than simply compensation and benefits. Other expenses include:

- If they work in a physical office, they will require space, utilities, and equipment.

- Administrative assistance: Many CFOs rely on assistants or financial teams to fulfill their everyday responsibilities.

- Companies invest in executive development, certifications, and industry events.

Total Cost of Hiring a Chief Financial Officer

When you bring everything together, including salary, perks, incentives, and overhead, the total cost of hiring a CFO may potentially approach $300,000 per year. It may cost more than $1 million for large companies.

This is a major financial burden for small and medium-sized firms. Many businesses use Virtual CFO (VCFO) services as a more cost-effective solution.

Cost Benefits of VCFO Services for Businesses

Save Direct Costs with Fractional CFO Services

The average salary for a CFO can range from ₹40 lakhs to ₹1 crore per year, depending on the industry, city, and size of the business. And that doesn’t even include bonuses, employee benefits, or infrastructure costs.

For many small and mid-sized Indian businesses, this is simply not sustainable.

That’s where the concept of a Virtual CFO (VCFO) becomes highly relevant. A VCFO provides the same degree of strategic financial expertise without the high price tag.

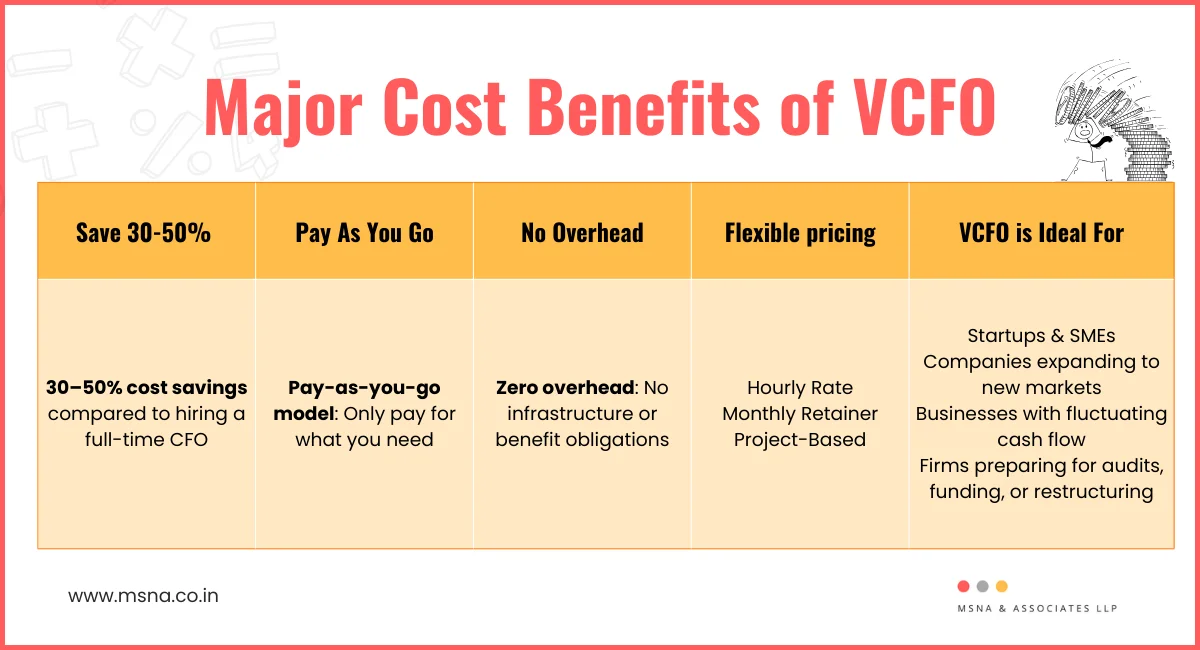

Outsourcing CFO services can reduce your finance leadership costs by at least 30–50%. Here’s how:

- No fixed salary: You only pay for what you need – be it a few hours each week or support for a specific quarter.

- No employee benefits: You don’t need to cover medical insurance, provident fund, gratuity, or bonuses.

- Zero office overhead: VCFOs work remotely, which means no extra spending on office space, equipment, or travel.

For instance, if a company is spending ₹75 lakhs per year on an in-house CFO, outsourcing to a VCFO could bring that cost down to ₹35 – ₹45 lakhs or even less, depending on your financial needs. Many businesses save even more by using VCFOs only for specific tasks like financial planning, tax strategies, or funding guidance.

VCFO Offers Flexible Payment Structures

With a VCFO, you have control over the expenditures. Unlike a full-time CFO, who has a fixed virtual CFO salary, outsourced CFOs offer:

- Hourly rates: Pay only for the time they work.

- Monthly retainers: Get ongoing support at a predictable cost.

- Project-based pricing: Hire a VCFO for specific tasks, like preparing for an audit or securing funding.

For instance, if a company is spending ₹75 lakhs per year on an in-house CFO, outsourcing to a VCFO could bring that cost down to ₹35 – ₹45 lakhs or even less, depending on your financial needs.

This flexibility is especially helpful for businesses with fluctuating financial needs. You get high-level financial expertise without overpaying.

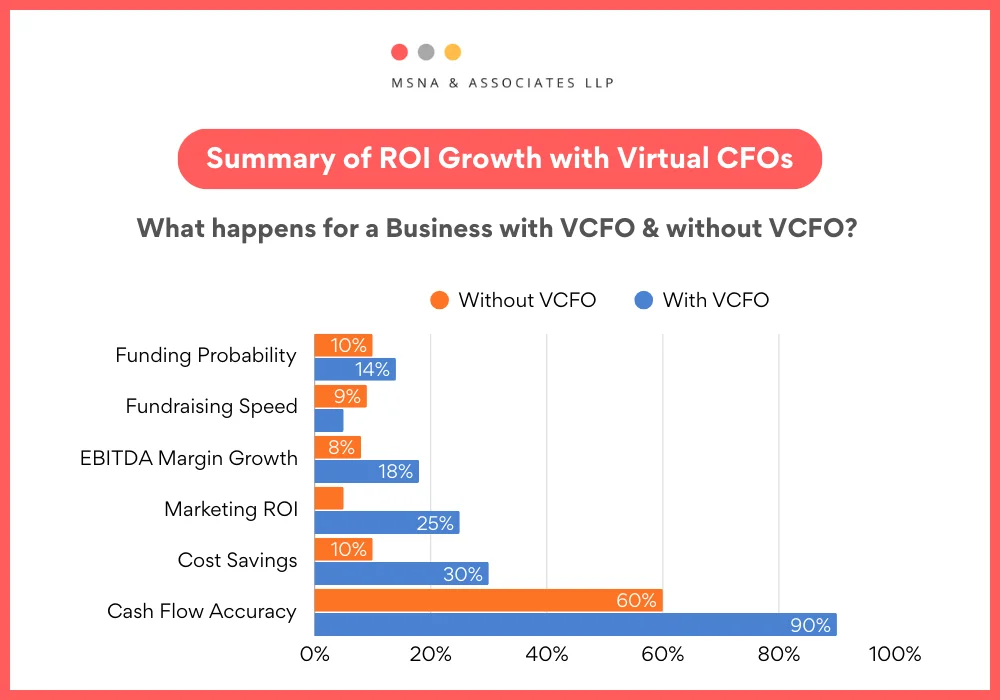

Additional Advantages of a VCFO For Your Business

Virtual CFOs (VCFOs) Provide Numerous Major Advantages for Businesses:

1. Virtual CFOs Offer Access to Financial Expertise

Virtual CFOs (VCFOs) frequently have experience in a variety of businesses. This diverse background enables them to provide significant insights to your company. With virtual CFO services, you gain access to expertise that spans multiple industries, allowing them to apply best practices to your financial strategy to maximize ROI. This broad knowledge can assist in identifying new opportunities and improving operations.

For example, a VCFO who has worked in retail, SaaS, and healthcare can provide insights that an in-house CFO (who has only worked in one area) may not have.

2. VCFO Offers Customized Solutions for Scalability

One of the primary benefits of VCFO services is their flexibility. As your business grows or faces challenges, your financial needs change. VCFOs can adjust their services accordingly, providing more support during busy times and scaling back when things are slower. This flexibility guarantees that you receive the appropriate degree of financial knowledge without having to commit to a full-time hire, which results in substantial cost benefits of VCFO services.

VCFOs adapt their services as your needs change. Whether you’re preparing for funding or entering a new market, they scale with you.

3. Objective Perspective

Having an external VCFO means receiving an objective assessment of your financial status. They are not impacted by internal company dynamics and can provide unique viewpoints on financial issues. This objectivity can lead to better decision-making and novel approaches to financial difficulties.

For example, if a company is experiencing cash flow problems, an in-house CFO may be too close to the issue. VCFOs aren’t part of internal politics. They offer objective advice, helping you spot problems and solutions faster.

Add More Cost Benefits with VCFO: Hiring a Virtual CFO for Smarter Financial Management

Unlike a full-time CFO, a VCFO offers flexible, cost-effective solutions that can reduce expenses by at least 30%. You get the insights and strategies of an experienced CFO without the high salary, benefits, and overhead costs.

Many businesses have successfully streamlined their finances by opting for Virtual CFO services in India. With the right financial expertise, companies can focus on growth while ensuring strong financial management.

In today’s competitive market, every rupee counts. By outsourcing CFO services, businesses can experience the cost benefits of a VCFO, allowing them to invest more in expansion while maintaining financial stability.

If you’re looking for a smarter way to manage your company’s finances, a VCFO might be the perfect solution.