“Startups won’t fail because they lack a great idea. They fail because they run out of money. A Virtual CFO plugs this gap by acting as a financial co-founder,” said Amit Singal, Founding Partner at Startup Buddy.

Businesses and startups often face financial obstacles that require strategic planning and execution to tackle them. That’s why you need a Virtual CFO to offer expert financial guidance for your company.

Virtual CFOs are preferred for their cost-effective services equivalent to full-time financial executives. Plus, it provides you with flexibility in taking their finance services only when your business needs them.

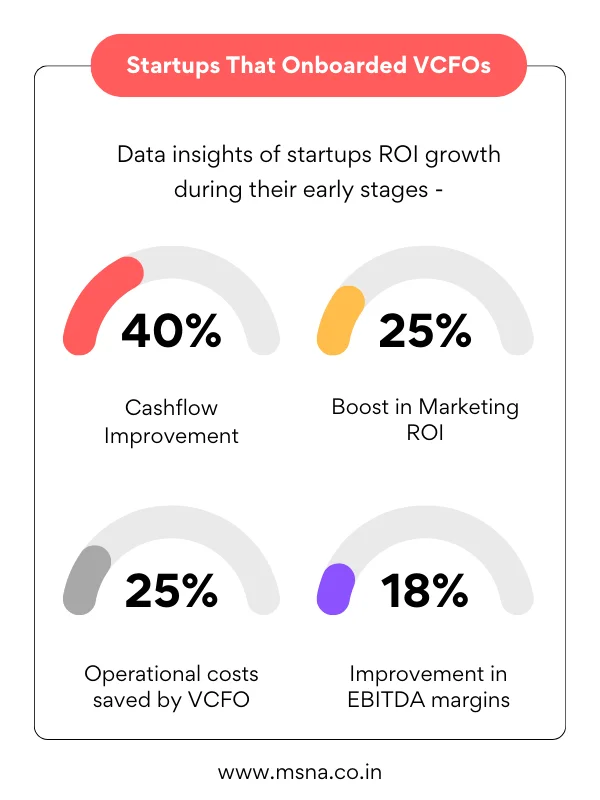

In this article, let’s get to know how VCFOs maximize the ROI of your business. Let’s get started!

Table of Contents

How Virtual CFOs Are Maximizing ROI While Evaluation Opportunities for Businesses?

A Virtual CFO, also referred to as an outsourced CFO or part-time CFO, is a financial specialist who provides top-level financial expertise to businesses. They offer services equivalent to a full-time CFO without long-term commitment and costs.

A Virtual CFO, also referred to as an outsourced CFO or part-time CFO, is a financial specialist who provides top-level financial expertise to businesses. They offer services equivalent to a full-time CFO without long-term commitment and costs.

They work remotely and leverage cloud-based tools and advanced technology to manage a company’s financial processes, approaches, and compliance. This ultimately gives businesses access to top-tier financial expertise equivalent to an in-house CFO. We have a dedicated article explaining “What is Virtual CFO“, refer to this for better learning on the key roles & responsibilities of VCFO.

Who Needs a Virtual CFO?

Virtual CFOs are particularly beneficial for:

- Growing Businesses & Startups require Virtual CFOs to grow their organizations with better planning, forecasting, and strategic investments.

- Small to Medium businesses (SMBs) requiring expert financial help at affordable costs can opt for a VCFO

- Established Companies can benefit from digital transformation and risk management services offered by CFOs.

- Businesses Facing Financial Challenges, such as cash flow issues, debts, and operational inefficiencies, can hire virtual executives to tackle the challenges.

How VCFOs Maximize ROI? Strategies They Use

Virtual CFOs deploy different tactical approaches to boost returns and uncover new opportunities.

Here are 10 Key Strategies VCFOs Use to Maximize Your Return on Investments –

1. Budgeting and Forecasting

Financial Planning: VCFOs develop comprehensive budgets that account for current expenses and future growth. Using data analytics and industry best practices, they create long-term financial objectives.

Statistical Forecasting: By assessing historical data, seasonal fluctuations, and market trends, they help businesses set realistic revenue targets.

This way, they help firms manage spending, allocate capital, and prepare for future opportunities or downturns.

2. Cost Optimization

Expense Auditing: Virtual CFOs conduct detailed auditing of resources to map areas where money can be saved. They review vendor contracts, assess operational processes, and look for inefficiencies that cause unnecessary expenses.

Strategic Savings: CFOs cut waste spending, renegotiate better deals, and free up funds that can be redirected into higher-return areas.

Cash Flow Management: Plus, they monitor incoming and outgoing funds, ensuring invoices are collected and bills are paid on time.

3. Data-Driven Decisions

Monitor Analytics: Virtual CFOs use real-time dashboards and KPI tracking to monitor sales, revenue, expenses, and industry trends.

Operational Optimizations: Through data, they determine underperforming areas, identify growth opportunities, and make operational adjustments.

This cuts down guesswork as the decision-making is entirely based on solid data.

“The use of part-time or outsourced financial officers is seen as a game-changer for micro and small businesses. Technology-driven CFO support reduces compliance errors and improves investor confidence.”

— Source: msme.gov.in

4. Revenue Enhancements

New Markets: Virtual CFOs do in-depth market studies to identify new markets and customer segments.

Pricing Strategies: They review competitors’ pricing and turnovers to recommend different pricing strategies that attract more customers and improve profit margins.

Diversification of Products: Virtual CFOs work with different departments to identify trends and customer needs, helping the business introduce new products or services

5. Capital Structure Optimization

Financial Strategy: By assessing a company’s financial health and recommending optimal funding resources, thus aligning monetary decisions with strategic goals.

Balancing Risk and Cost: By balancing interest expenses with shareholder equity, they reduce risk and improve financial stability.

Debt Management: By reviewing the company’s loans and refinance high-interest loans or restructure existing debt to secure better terms. This releases cash for new opportunities without burdening the company with interest payments.

6. Investment and Capital Allocation

Investment Planning: CFOs evaluate potential projects by comparing their possible benefits and risks. Using simple models, they decide which projects are likely to bring the maximum returns.

Portfolio Optimization: By evaluating risk-return profiles and diversification, VCFOs help you optimize your investment portfolios.

7. Stakeholder Management

Investor Relations: CFOs foster strong relationships with investors by sharing accurate financial reports and plans. This keeps stakeholders informed and aligned with the company’s long-term visions.

Regulatory Compliance: They ensure compliance with regulatory requirements, maintain a positive reputation, and avoid legal issues.

8. Partnerships & Scalability

Strategic Collaborations: VCFOs seek partnerships that give your company access to additional expertise, technology, or new market entrance.

Widening Expertise: VCFOs partner with companies that possess specialized skills to benefit from areas where your company might lack in-house capabilities.

Scale Operations: A virtual CFO can adjust strategies as your organization grows to handle increasing financial complexities, thus making it easier to scale business processes.

9. Digital Advancement

Financial Automation: Virtual financial officers use automated software systems like cloud-based accounting software to automate tasks. This increases accuracy and efficiency while minimizing manual errors.

Technology Integration: Virtual CFOs help companies adopt technology to optimize workflows, improve efficiency, and control costs.

10. Risk Management & Compliance

Risk Mitigation: Virtual CFOs implement internal controls and compliance systems to manage financial risks and adhere to changing regulations.

Tax Planning: They structure transactions and operations in a tax-efficient manner, making sure that the company minimizes its tax liabilities and penalties.

The role of Virtual CFOs in maximizing your business ROI isn’t restricted to just these approaches, but more. With the best Virtual CFO, you can completely focus on the core operations of your firm while the CFO will tackle the financial headaches.

Why Your Business Needs a VCFO? How they Can Help apart from Maximizing ROI?

Hiring a virtual CFO is a smart choice as it is both cost-effective and you get access to expert financial leadership.

Here are some key benefits of having a virtual CFO:

- Hiring a virtual CFO eliminates the financial burden of a full-time CFO’s salary, benefits, and overhead costs.

- Plus, VCFO services are priced based on particular business models, that is you can pay for the required services and time.

- Businesses can modify their engagement levels as required, scaling up or down based on the demand.

- Companies can engage with virtual officers on flexible terms, going with part-time or project-based arrangements ensuring access to high-level financial expertise.

Bottom line: Virtual CFOs often have wide networks within the financial industry, offering access to investment opportunities, banking relationships, and specialized financial services

“VCFOs are now becoming a part of the startup DNA—especially post-Series A—where founders need to focus on scaling, and the financial roadmap has to be precise.”

Ankur Mittal, Co-Founder - Inflection Point Ventures

Final Words

Virtual CFOs are more than just financial managers and they are crucial for your business to make informed decisions when it comes to monetary aspects. VCFOs maximize ROI with various strategies that a founder or co-founder might not be aware of. They streamline financial workflow, reduce extra costs, and identify new revenue streams to improve the long-term financial health of your corporation.

At M S N A Associates, we offer Virtual CFO services to enhance the financial and accounting aspects of your business while sticking to required compliances.